Top Stories

Rafaella Santos And André Lamoglia Seen Together In Rio

Rafaella Santos was seen again in the company of André Lamoglia, heartthrob of the Spanish series “Elite”. The two were

These 12 Young Entrepreneurs Are Turning Their Industries On Their Heads

Original Story: These 12 Young Entrepreneurs Are Turning Their Industries On Their Heads Being a young entrepreneur is no easy However these 12 amazing entrepreneurs make it look easy! They are making waves and changing industries ranging from digital…

Business

Stocks and bonds wobble as global economy throws off mixed signals

By Harry Robertson LONDON (Reuters) – Investors have gone from bracing for a U.S. recession to positioning for the world’s

Top Business Magazines Trending Now

The Daily Grind Magazine

The Daily Grind Magazine brings business owners, CEO’s, Founders, and Entrepreneurs the latest business, real estate, investing, and entrepreneurship news from around the world.

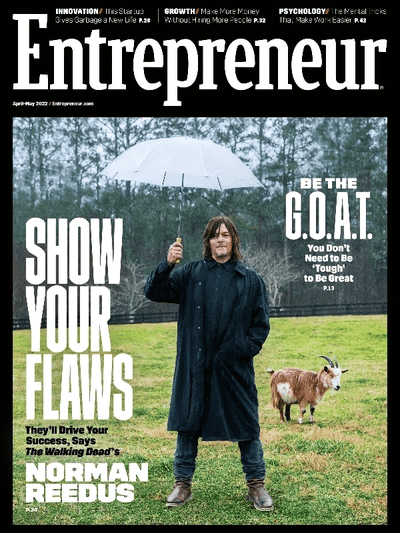

Entrepreneur Magazine

Entrepreneur is an American magazine and website that carries news stories about entrepreneurship, small business management, and business.

Young Innovators Magazine

Young Innovators Magazine highlights young innovators, business owners, CEO’s & Founders, and Entrepreneurs the latest business news from around the world.

Billionaire Investor Magazine

Billionaire Investor Magazine brings high net worth investors, business owners, CEO’s & Founders, and Entrepreneurs the latest business news from around the world.

RealTech Magazine

RealTech Magazine brings their readers the latest news and stories from around the world revolving around technology, business, crypto, blockchain, entrepreneurship, and more.

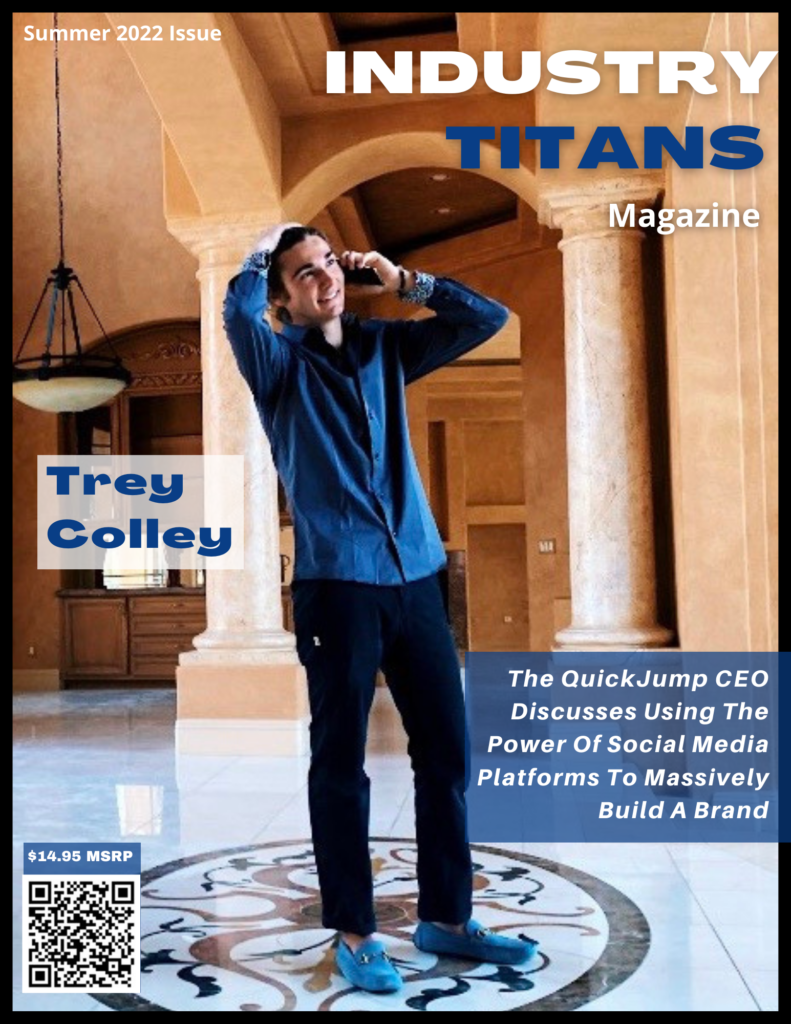

Industry Titans Magazine

Industry Titans Magazine brings business owners, CEO’s & Founders, and Entrepreneurs the latest news from around the world focusing on business & startups founded by young entrepreneurs.

Entertainment

Kendall & Bad Bunny, Gisele Mad at Tom, Caitlin Clark

It’s hump day in the week — and we’re gonna help you get passed it with our TV topics! TMZ

Why Kim Kardashian Skipped the 2024 Met Gala After-Parties

Even after fashion’s biggest night, Kim Kardashian got her f–cking ass up and worked. The SKIMS founder made heads turn with her 2024 Met Gala look,

Linda Evangelista Returns to the Met Gala for the First Time in 9 Years

Linda Evangelista made her Met Gala return on Monday, and stunned in her first appearance since 2015. The iconic supermodel

Top Entertainment Magazines Trending Now

Via Luxury Magazine

Via Luxury Magazine is both a print and digital magazine offering our readers the latest news, videos, thought-pieces, etc. on various luxury Lifestyle topics.

The Gentleman Magazine

The Gentleman Magazine is both a print and digital magazine offering gentleman readers the latest news, videos, thought-pieces, etc. on various Lifestyle topics every good gentleman follows.

Millennial Lifestyle Magazine

Millennial Lifestyle Magazine is both a print and digital magazine offering readers the latest news, videos, thought-pieces, etc. on various Millennial Lifestyle topics.

Health

Religion

Real Estate

London Houseboats Used to Be an Affordable Alternative. Not Anymore.

When you walk along the towpaths lining London’s 100-mile network of canals, a life on the water can appear idyllic.

Why the 30-year fixed-rate mortgage is a ‘uniquely American construct’

monkeybusinessimages | Getty Most U.S. homebuyers taking out a mortgage opt for a 30-year fixed-rate option — but they may

As court overturns a lot-splitting law, one early adopter asks why

Sam Andreano is currently putting the finishing touches on his split-lot property in Whittier. He’s a guinea pig for state

Automotive

Cartime gears up for growth and expansion with new senior hire from Hippo

North west independent used car dealer Cartime is readying for a year of rapid growth and expansion with the appointment

Lucid stock down on Q1 loss, confirms Gravity SUV on track for ‘late 2024’ launch

EV maker Lucid (LCID) reported mixed first quarter results as a wider-than-expected loss trumped the company’s confirmation that its Gravity

The 2024 BMW X5 M Competition

As modern tire and suspension technology allows large machines to accelerate and corner like proper lightweights, there are more options