UST Rebounds From $.66 per Coin to $.93, Crypto Group Assesses Stablecoin’s Damaged Reputation – Bitcoin News

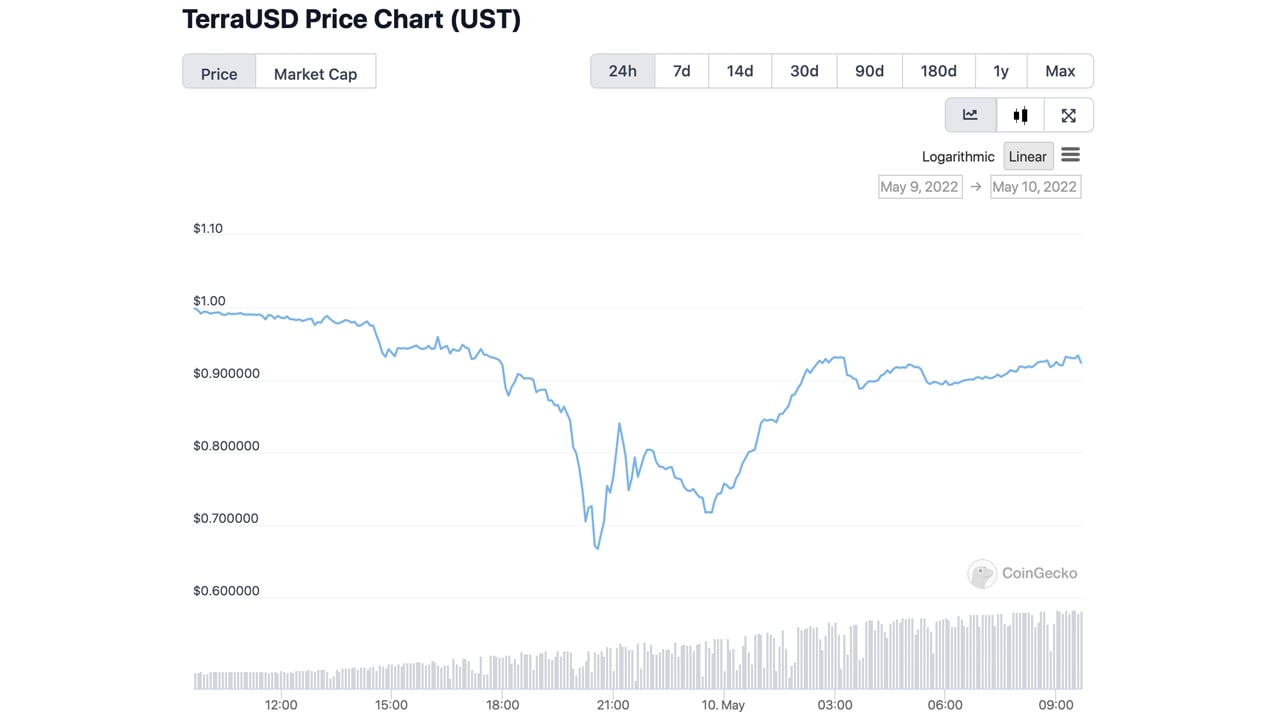

On Monday, May well 9, 2022, the stablecoin terrausd (UST) missing its parity with the U.S. greenback and dropped to an all-time reduced of $.66 for every device. The stablecoin has been a single of the most topical conversations in crypto all through the previous 24 several hours, as lots of have been betting on no matter whether it will fail or get better. However, by 9:15 a.m. (ET) on Tuesday morning, the stablecoin has managed to climb back to $.934 for every unit.

UST Stablecoin Plunged to $.66 for every Unit, Rumors Spread Like Wildfire

The Terra blockchain venture has been struggling in current situations, as the network’s native asset LUNA has shed 43.6% versus the U.S. dollar through the previous 24 hours. In addition, the stablecoin terrausd (UST) has also been dealing with extreme force as the token’s benefit plummeted from $.99 to a low of $.66 per device. On a handful of exchanges, UST dropped as small as $.62 per device during periods of extreme providing. Just ahead of UST dipped $.09 lessen than the $1 peg, Terra’s co-founder Do Kwon informed the general public that the group was “deploying far more money.”

A-Group is assembling.

— Terra (UST) 🌍 Powered by LUNA 🌕 (@terra_dollars) Could 9, 2022

For the duration of the system of Monday night, the Luna Basis Guard (LFG) emptied the LFG bitcoin wallet that after held around 70,736.37 BTC. At this time, there is zero bitcoin in the wallet as it has been drained dry. The very same can be said for the LFG Gnosis safe handle, as the ethereum tackle held $143 million on May possibly 3. Right now, the wallet holds $135.58 in ether, and a couple other ERC20 tokens with modest values. When LFG and Do Kwon explained to the public on Monday that $1.5 billion in bitcoin and UST would be lent to market makers, the present moves have been much less clear.

Even though UST plunged to $.66 for each unit, a massive selection of theories swirled around the crypto marketplace. There have been claims that the multinational hedge fund and financial expert services organization Citadel was included. Stories even more assert that Binance purchase textbooks experienced paused through the UST promote-off. For a modest time period of time, Binance paused LUNA and UST withdrawals. Moreover, there is been communicate of effectively-recognized crypto money bailing out Terra as effectively, by funneling billions again into the stablecoin’s ecosystem.

“There is a rumor spreading about Leap, Alameda, etcetera. giving a different $2B to ‘bail out’ UST,” theblockcrypto head of exploration Larry Cermak tweeted on Monday evening. “Whether this rumor is true or not, it makes fantastic sense for them to unfold. The most important question listed here is, even if they can get it to $1 by some miracle, the believe in is irreversibly absent.”

Immediately after UST Rebounds to $.93, Persons Question Trusting the Stablecoin Task, Anchor TVL Slips by 43% in a Solitary Day

Conversations about folks dropping belief in LUNA, UST, and Terra, in basic, have been littered all above social media. “No make any difference how this finishes, I really don’t want persons to phone UST decentralized once again,” the bitcoin advocate Hasu tweeted on Monday. “Even the tiny collateral backing it has is intransparent and controlled by a single celebration. Utilized to conduct discretionary open up marketplace operations. This is like 10x even worse than the Fed,” Hasu extra.

😶 $UST stablecoin peg breaking…

Same story as with any central financial institution hoping to defend a forex peg: once the current market casts a no self-assurance vote, your prop-up fund seldom has more than enough belongings to prevent the dam from breaking. pic.twitter.com/x3llQtABmv

— Tuur Demeester (@TuurDemeester) Could 9, 2022

Investor Lyn Alden also designed a assertion about the Terra disaster just after she predicted it could materialize last month. “Terra’s multi-billion-dollar algorithmic stablecoin UST blew up nowadays,” Alden said. “Aside from destroying the price of LUNA, they utilised their bitcoin reserves to attempt to defend the peg, sort of like a flailing emerging sector applying its gold reserves to defend its Fx.”

All through the right away buying and selling periods and into the trading sessions on Tuesday early morning, UST has been recovering from the losses. So much, terrausd (UST) has managed to climb back again to $.934 per unit, or down 6% from the $1 parity. Terra’s co-founder Do Kwon has not tweeted considering that saying the ‘A-team’ was deploying funds, even although the co-founder is very nicely-regarded for defending his undertaking. At the exact same time, LFG has also not current the community due to the fact its final tweet, which explained it would offer far more updates.

Mark my phrases. The UST failure will be utilized as proof by coverage makers to regulate stablecoins to loss of life and champion CBDCs.

This is not very good.

— Dennis Porter (@Dennis_Porter_) May 10, 2022

In addition to the issues with LUNA’s and UST’s selling price, the decentralized finance (defi) lending protocol Anchor has drop 43.7% of its total worth locked (TVL) all through the earlier 24 hours. At the time of crafting, Anchor has a TVL of all around $7.22 billion and $95.08 million is Avalanche-centered collateral. Anchor was the moment the 3rd-biggest defi protocol, and it has dropped down to the sixth posture on Tuesday.

People in tradfi building fun of UST… not knowing their stablecoin also depegged by 8% this calendar year.

— Erik Voorhees (@ErikVoorhees) Could 10, 2022

Lots of speculate what is heading to transpire if UST regains its $1 parity with trust in the stablecoin so shaken. Quite a few UST entrepreneurs could be waiting around for the $.99 spot or near to that range, so they can dollars out of the stablecoin and go into anything else. At $.934141, UST is nearer to the $1 parity, but an investment decision of 5,000 UST would only equate to $4,670.70 at current selling prices.

Tags in this story

$1 Parity, Anchor, Anchor TVL, Bail Outs, Binance, Bitcoin Wallet, citadel, Deploying Capital, do kwon, Dollar Peg, Hasu, lfg, LFG wallets, LUNA, LUNA down, luna foundation guard, Lyn Alden, Stablecoin, Stablecoin UST, terra (LUNA), USDC, USDT, UST

What do you think about the Terra project’s issues and the the latest UST de-pegging? Let us know what you imagine about this subject in the responses portion underneath.

Jamie Redman

Impression Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This short article is for informational uses only. It is not a immediate present or solicitation of an supply to invest in or provide, or a suggestion or endorsement of any items, solutions, or businesses. Bitcoin.com does not deliver financial commitment, tax, authorized, or accounting guidance. Neither the business nor the author is liable, instantly or indirectly, for any destruction or reduction induced or alleged to be triggered by or in link with the use of or reliance on any material, products or services talked about in this post.