Top Stories

Rafaella Santos And André Lamoglia Seen Together In Rio

Rafaella Santos was seen again in the company of André Lamoglia, heartthrob of the Spanish series “Elite”. The two were

These 12 Young Entrepreneurs Are Turning Their Industries On Their Heads

Original Story: These 12 Young Entrepreneurs Are Turning Their Industries On Their Heads Being a young entrepreneur is no easy However these 12 amazing entrepreneurs make it look easy! They are making waves and changing industries ranging from digital…

Business

AI is shaking up sports like rugby, soccer and cricket are played

Leicester Tigers, an English rugby team, finished at the bottom of the sport’s Premiership in 2019, just about missing relegation.

Top Business Magazines Trending Now

The Daily Grind Magazine

The Daily Grind Magazine brings business owners, CEO’s, Founders, and Entrepreneurs the latest business, real estate, investing, and entrepreneurship news from around the world.

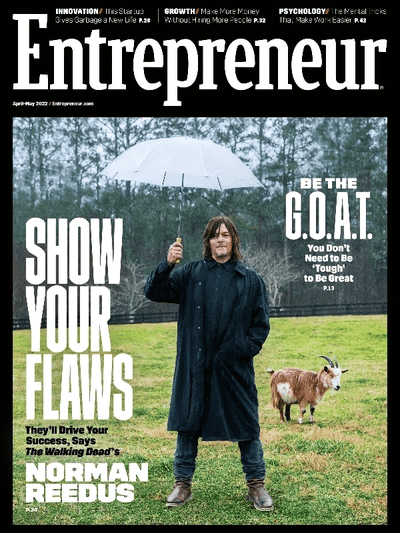

Entrepreneur Magazine

Entrepreneur is an American magazine and website that carries news stories about entrepreneurship, small business management, and business.

Young Innovators Magazine

Young Innovators Magazine highlights young innovators, business owners, CEO’s & Founders, and Entrepreneurs the latest business news from around the world.

Billionaire Investor Magazine

Billionaire Investor Magazine brings high net worth investors, business owners, CEO’s & Founders, and Entrepreneurs the latest business news from around the world.

RealTech Magazine

RealTech Magazine brings their readers the latest news and stories from around the world revolving around technology, business, crypto, blockchain, entrepreneurship, and more.

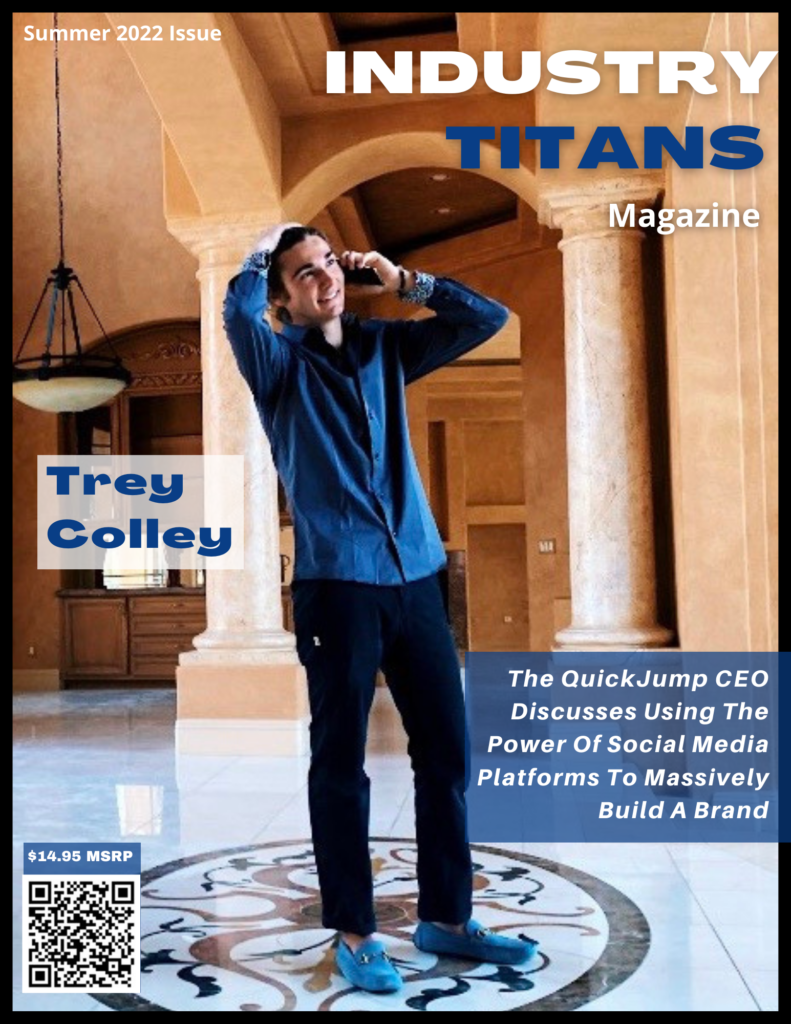

Industry Titans Magazine

Industry Titans Magazine brings business owners, CEO’s & Founders, and Entrepreneurs the latest news from around the world focusing on business & startups founded by young entrepreneurs.

Entertainment

Zendaya Reacts to Venus and Serena Williams Seeing Her Tennis Movie ‘Challengers’ (Exclusive)

Zendaya is revealing what some tennis greats thought about her latest performance. ET’s Denny Directo spoke to the actress and

Louis Gossett Jr. Cause Of Death Revealed

Oscar-winning actor Louis Gossett Jr. died of a lung condition, according to his death certificate obtained by TMZ. The actor

GloRilla DUI Arrest on Body Cam Video, Does Multiple Sobriety Tests

Play video content GloRilla got put through the gauntlet of a typical DUI arrest — having to do a bunch

Top Entertainment Magazines Trending Now

Via Luxury Magazine

Via Luxury Magazine is both a print and digital magazine offering our readers the latest news, videos, thought-pieces, etc. on various luxury Lifestyle topics.

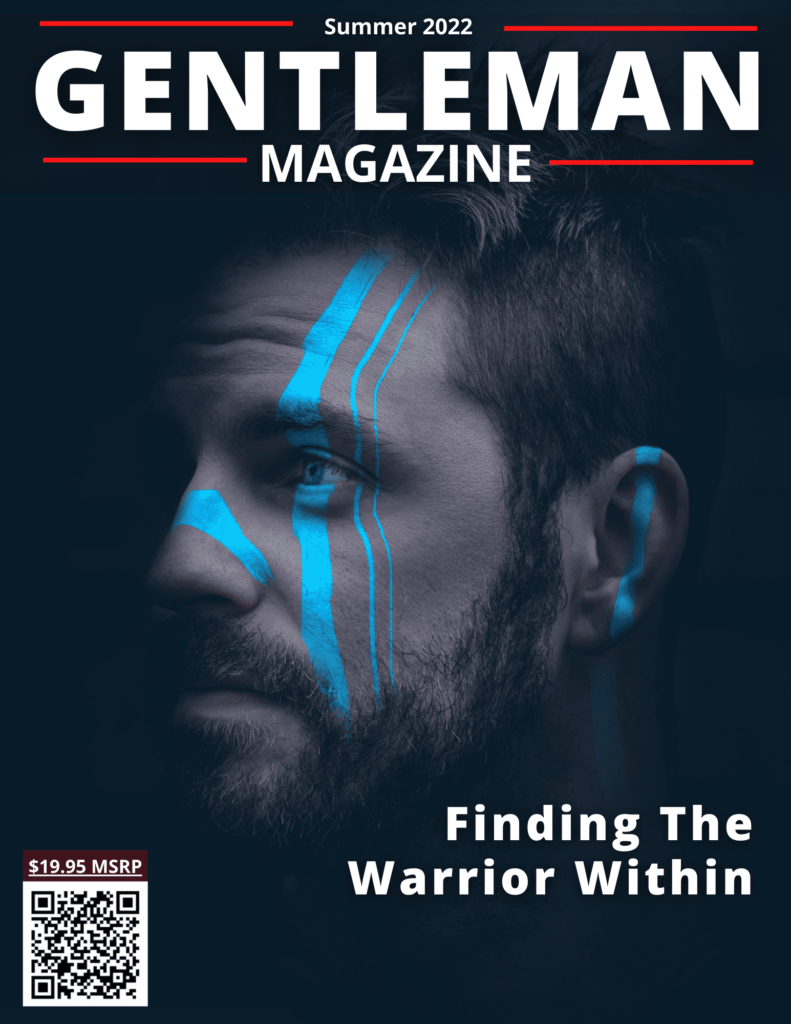

The Gentleman Magazine

The Gentleman Magazine is both a print and digital magazine offering gentleman readers the latest news, videos, thought-pieces, etc. on various Lifestyle topics every good gentleman follows.

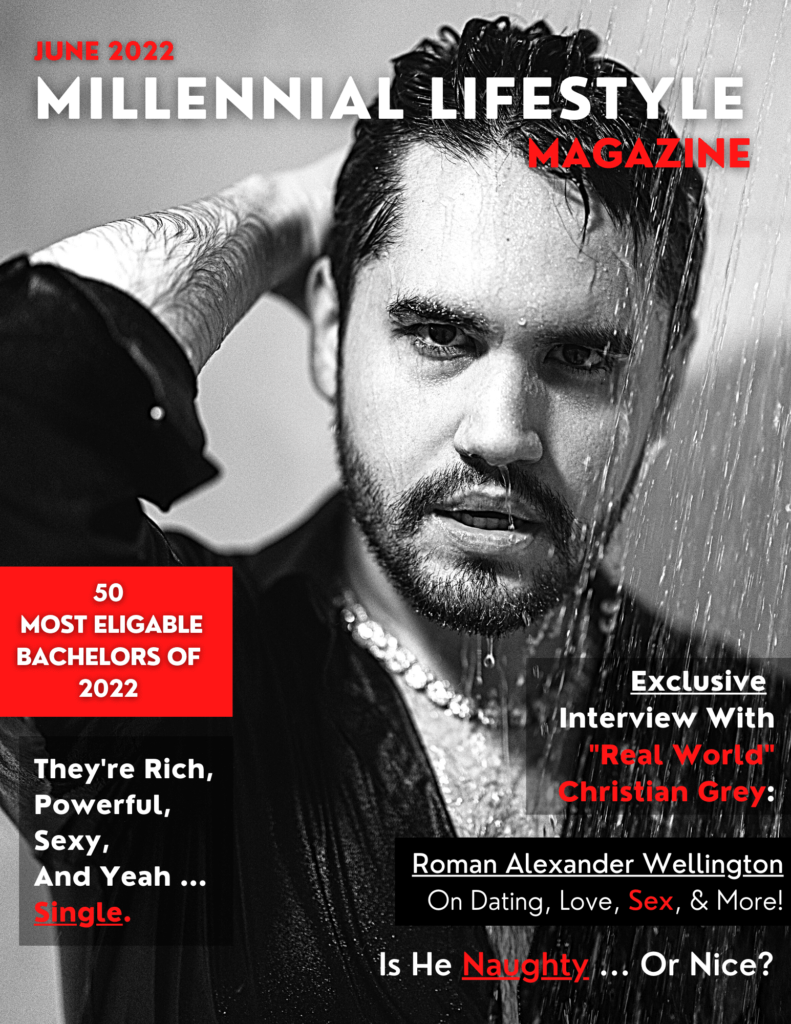

Millennial Lifestyle Magazine

Millennial Lifestyle Magazine is both a print and digital magazine offering readers the latest news, videos, thought-pieces, etc. on various Millennial Lifestyle topics.

Technology

Health

Religion

Real Estate

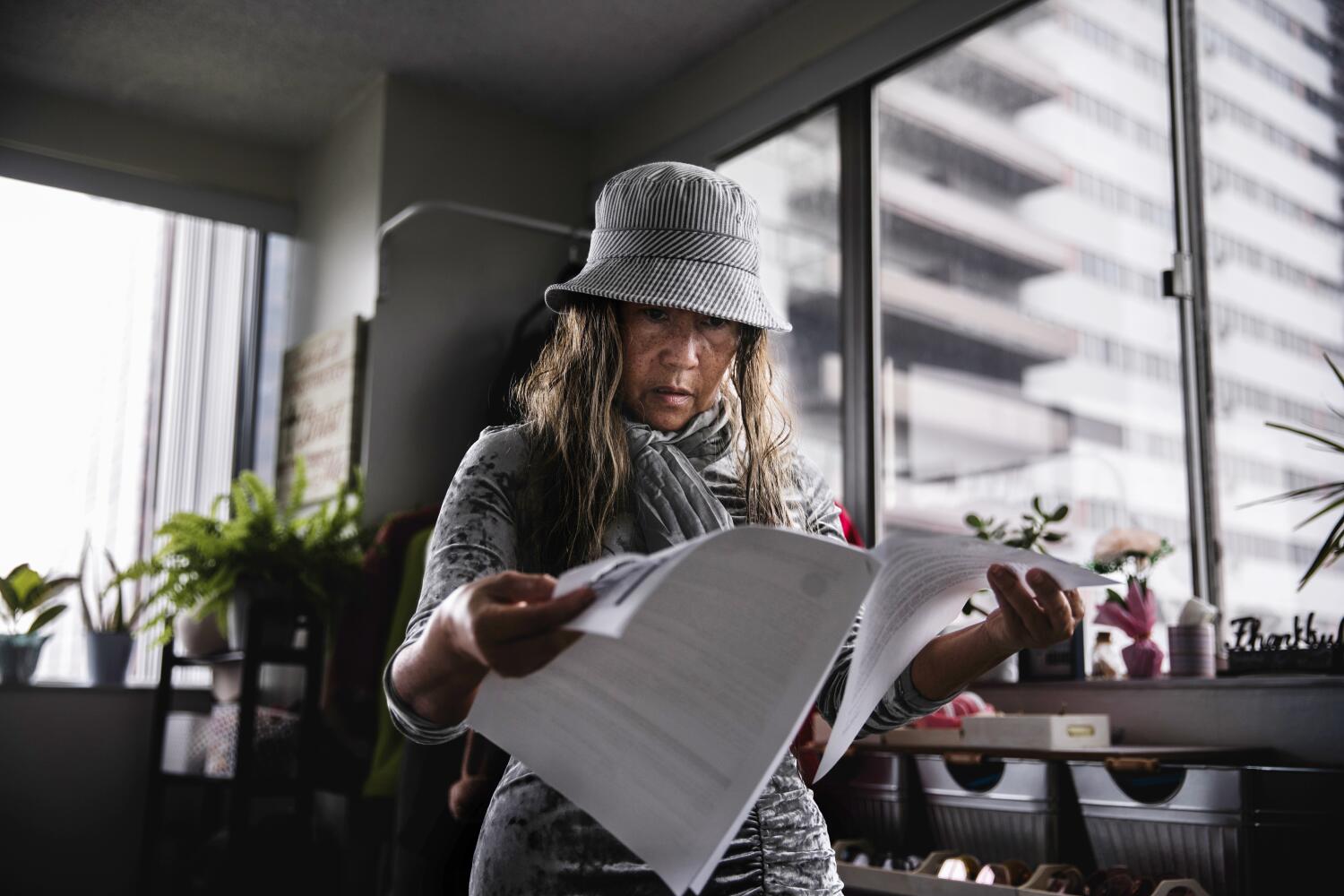

Westside residents are fighting mass eviction in court.

Nearly a year ago, every tenant at the massive Westside apartment complex Barrington Plaza was served with an eviction notice

Realtor.com Campaign Makes Pitch For Buyer Representation

The campaign will roll out across print and digital media and comes against the backdrop of commission disruption and intense

100% Financing for First-Time Home Buyers is HERE

If you’re a first-time home buyer, now may be one of the best times to get a loan in recent

Automotive

UAW clinches watershed union victory at VW’s Tennessee factory

A Volkswagen employee celebrates results of the unionization vote. (Getty Images) CHATTANOOGA, Tennessee — Workers at Volkswagen’s Tennessee plant

The Best Lamborghini Murcielagos For Sale Today

With the Murcielago growing in rarity and value everyday, this is your chance to buy an investment-grade Lamborghini. Lamborghini has

Which Is Better For Your Mercedes?

For vehicle owners and mechanics, the ongoing argument of whether to use genuine parts vs aftermarket parts is a tough