Top Stories

Rafaella Santos And André Lamoglia Seen Together In Rio

Rafaella Santos was seen again in the company of André Lamoglia, heartthrob of the Spanish series “Elite”. The two were

These 12 Young Entrepreneurs Are Turning Their Industries On Their Heads

Original Story: These 12 Young Entrepreneurs Are Turning Their Industries On Their Heads Being a young entrepreneur is no easy However these 12 amazing entrepreneurs make it look easy! They are making waves and changing industries ranging from digital…

Business

Duckhorn Portfolio names new CEO and completes vineyard acquisition By Investing.com

ST. HELENA, Calif. – The Duckhorn Portfolio, Inc. (NYSE: NAPA), a prominent luxury wine company in North America, announced the

Top Business Magazines Trending Now

The Daily Grind Magazine

The Daily Grind Magazine brings business owners, CEO’s, Founders, and Entrepreneurs the latest business, real estate, investing, and entrepreneurship news from around the world.

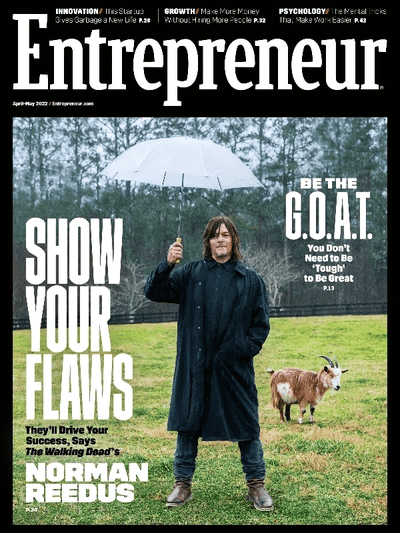

Entrepreneur Magazine

Entrepreneur is an American magazine and website that carries news stories about entrepreneurship, small business management, and business.

Young Innovators Magazine

Young Innovators Magazine highlights young innovators, business owners, CEO’s & Founders, and Entrepreneurs the latest business news from around the world.

Billionaire Investor Magazine

Billionaire Investor Magazine brings high net worth investors, business owners, CEO’s & Founders, and Entrepreneurs the latest business news from around the world.

RealTech Magazine

RealTech Magazine brings their readers the latest news and stories from around the world revolving around technology, business, crypto, blockchain, entrepreneurship, and more.

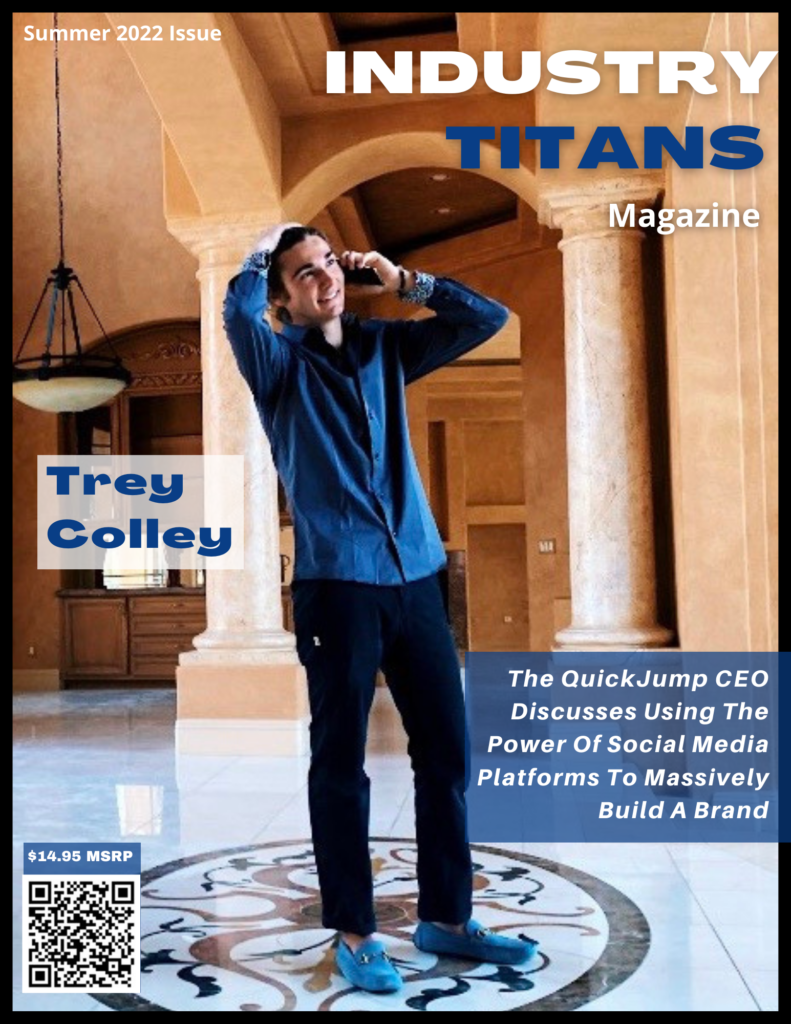

Industry Titans Magazine

Industry Titans Magazine brings business owners, CEO’s & Founders, and Entrepreneurs the latest news from around the world focusing on business & startups founded by young entrepreneurs.

Entertainment

Homecoming’ Season 3 Gets CW Premiere Date

The CW has set Monday, July 8 for the season 3 premiere of All American: Homecoming. Additionally, the mothership series

Wild Fight Breaks Out After Fan Slaps Rapper Stunna Girl’s Butt

Play video content Facebook / Dessy Blancoo A new video shows a fight breaking out at a concert … with

Yes, That’s Jax & Brittany at the White House Correspondents’ Dinner

Raise your glasses high because Jax Taylor and Brittany Cartwright have reunited for a special night out. Yes, nearly three months after

Top Entertainment Magazines Trending Now

Via Luxury Magazine

Via Luxury Magazine is both a print and digital magazine offering our readers the latest news, videos, thought-pieces, etc. on various luxury Lifestyle topics.

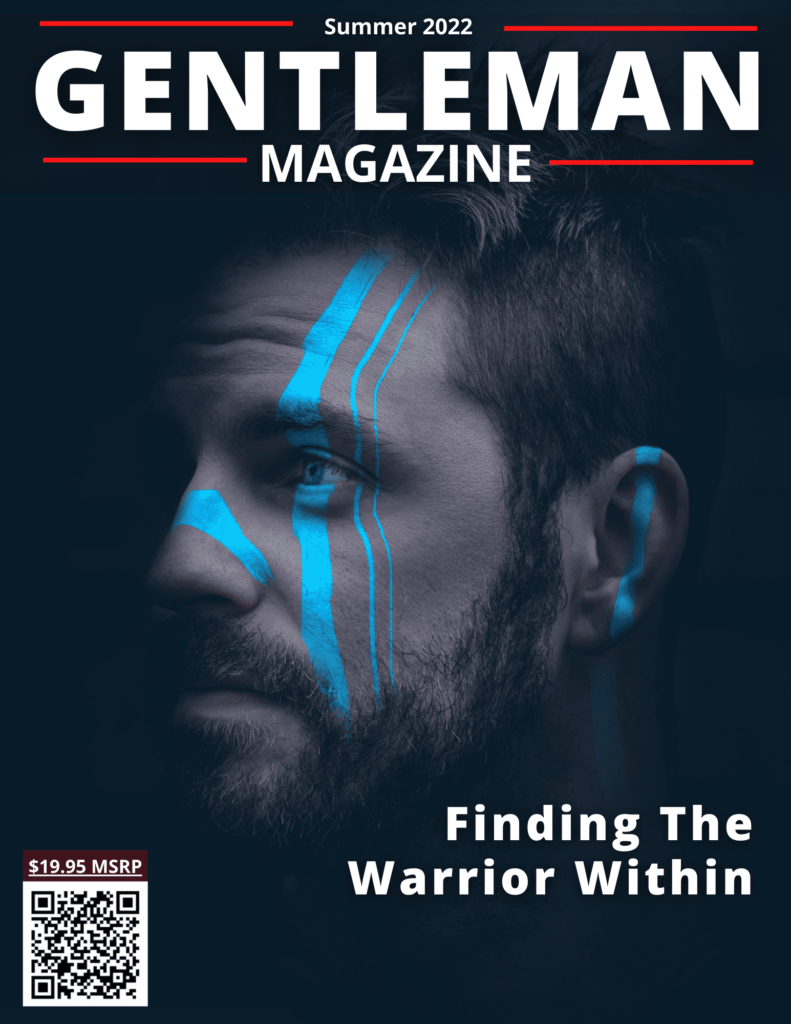

The Gentleman Magazine

The Gentleman Magazine is both a print and digital magazine offering gentleman readers the latest news, videos, thought-pieces, etc. on various Lifestyle topics every good gentleman follows.

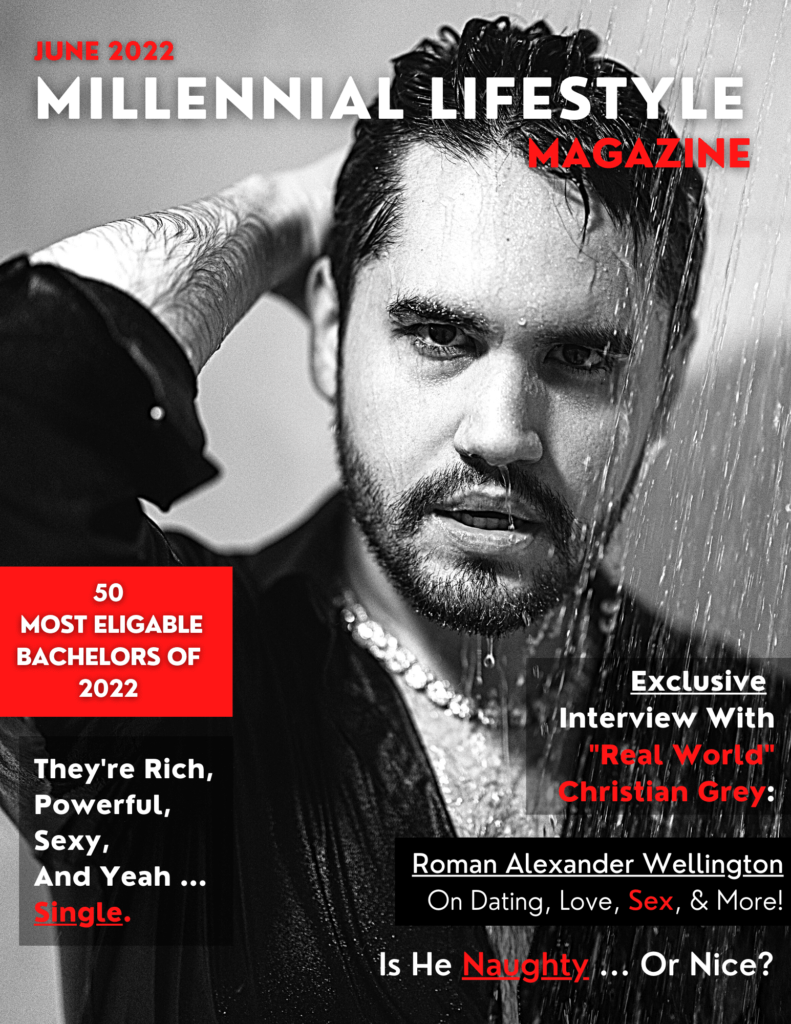

Millennial Lifestyle Magazine

Millennial Lifestyle Magazine is both a print and digital magazine offering readers the latest news, videos, thought-pieces, etc. on various Millennial Lifestyle topics.

Real Estate

What that means for your money

The Federal Reserve announced Wednesday it will leave interest rates unchanged as inflation continues to prove stickier than expected. However, the move

Thousands of new apartments in L.A. have rent caps. Is yours one?

Alexa Castelvecchi was glad when she and her roommates found their new apartment about a year ago, in a modern

Ryan Reynolds Creates Zillow Ad Inspired By Hit Show “Bluey”

Hit children’s TV show “Bluey” is the inspiration for Zillow’s latest ad, which debuted Friday morning on NBC’s Today show.

Automotive

Aston Martin Reveals A New V12 And Teases A New Vanquish

The V12 returns to Aston Martin more glorious than ever. For decades, V12 engines have been the centerpieces of Aston

Electric G-Class Makes Its World Premiere In LA And Beijing

The fully electrified Mercedes-Benz G-Class just graced the Franklin Canyon Park event and the Beijing Auto Show. Key features that

2025 Genesis GV70 Gets Refreshing Updates w/OLED 27-Inch Screen : Automotive Addicts

Automotive Genesis is giving its popular GV70 luxury crossover a refreshing update for the 2025 model year, marking the midpoint