Top Stories

Rafaella Santos And André Lamoglia Seen Together In Rio

Rafaella Santos was seen again in the company of André Lamoglia, heartthrob of the Spanish series “Elite”. The two were

These 12 Young Entrepreneurs Are Turning Their Industries On Their Heads

Original Story: These 12 Young Entrepreneurs Are Turning Their Industries On Their Heads Being a young entrepreneur is no easy However these 12 amazing entrepreneurs make it look easy! They are making waves and changing industries ranging from digital…

Business

Vape distributor Greenlane receives Nasdaq non-compliance notice (NASDAQ:GNLN)

HAZEMMKAMAL Greenlane Holdings (NASDAQ:GNLN) received a notice from the listing qualifications department of Nasdaq notifying the cannabis accessories seller that it is not

Top Business Magazines Trending Now

The Daily Grind Magazine

The Daily Grind Magazine brings business owners, CEO’s, Founders, and Entrepreneurs the latest business, real estate, investing, and entrepreneurship news from around the world.

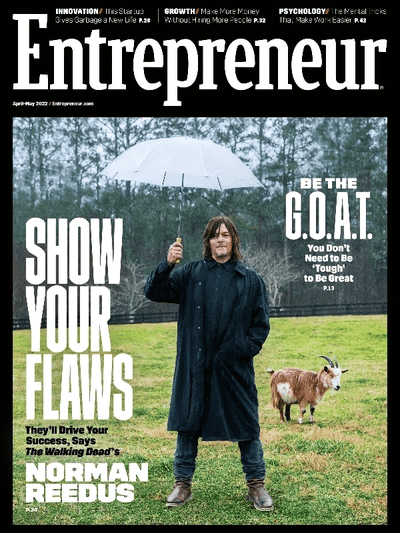

Entrepreneur Magazine

Entrepreneur is an American magazine and website that carries news stories about entrepreneurship, small business management, and business.

Young Innovators Magazine

Young Innovators Magazine highlights young innovators, business owners, CEO’s & Founders, and Entrepreneurs the latest business news from around the world.

Billionaire Investor Magazine

Billionaire Investor Magazine brings high net worth investors, business owners, CEO’s & Founders, and Entrepreneurs the latest business news from around the world.

RealTech Magazine

RealTech Magazine brings their readers the latest news and stories from around the world revolving around technology, business, crypto, blockchain, entrepreneurship, and more.

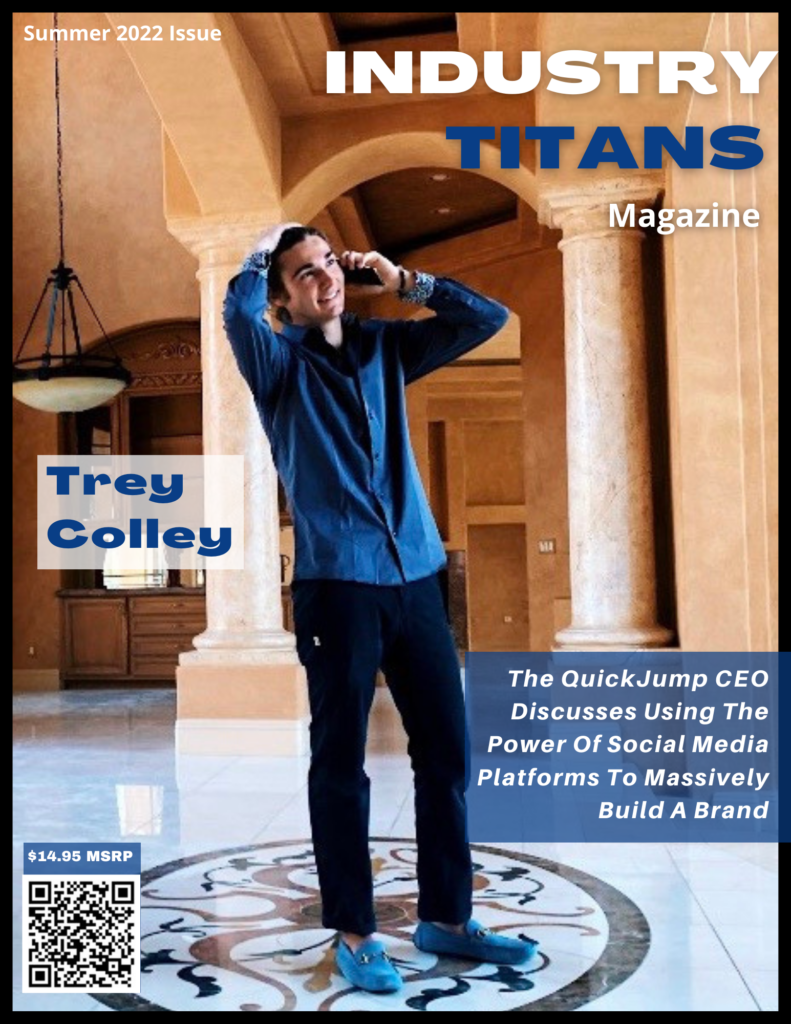

Industry Titans Magazine

Industry Titans Magazine brings business owners, CEO’s & Founders, and Entrepreneurs the latest news from around the world focusing on business & startups founded by young entrepreneurs.

Entertainment

David Mamet Calls Hollywood’s Diversity Efforts ‘Fascist Totalitarianism’

Play video content Festival of Books / Los Angeles Times David Mamet — who’s written some very famous screenplays in

All of Taylor Swift’s Nods to Ex Matty Healy in Her “Fortnight” Video

“Loml”: In this moving track, Taylor first sings about being called the love of someone’s life “about a million times.”

Samsung Spring Black Friday Sale 2024: Save Up to $1,900 on Appliances Ahead of Memorial Day

The seasonal savings continue at Samsung. It’s officially Black Friday in April with huge discounts on major appliances we haven’t seen

Top Entertainment Magazines Trending Now

Via Luxury Magazine

Via Luxury Magazine is both a print and digital magazine offering our readers the latest news, videos, thought-pieces, etc. on various luxury Lifestyle topics.

The Gentleman Magazine

The Gentleman Magazine is both a print and digital magazine offering gentleman readers the latest news, videos, thought-pieces, etc. on various Lifestyle topics every good gentleman follows.

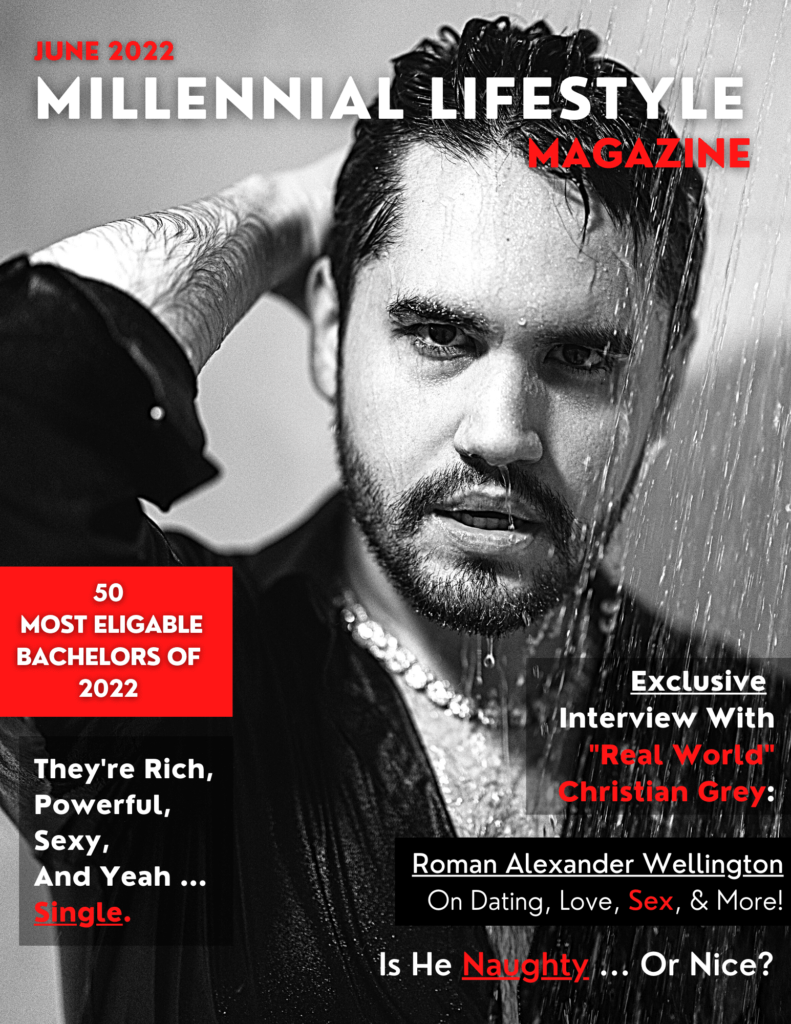

Millennial Lifestyle Magazine

Millennial Lifestyle Magazine is both a print and digital magazine offering readers the latest news, videos, thought-pieces, etc. on various Millennial Lifestyle topics.

Crypto

Real Estate

Judge Approves $418 Million Settlement That Will Change Real Estate Commissions

A settlement that will rewrite the way many real estate agents are paid in the United States has received preliminary

Luxury real estate prices hit an all-time record, Redfin says

Real estate is increasingly a tale of two markets — a luxury sector that is booming, and the rest of

Pratt and Schwarzenegger’s midcentury demo draws dismay

Chris Pratt and Katherine Schwarzenegger demolished a famed midcentury home designed by late architect Craig Ellwood to make room for

Automotive

Mercedes-Benz Reveals The First-Ever Electric G-Wagon

The SUV legend finally goes electric… officially. It’s been teased for quite some time, but throughout that period, it’s remained

Mercedes-Benz Ditches Plans For Two-Cylinder Range Extender

Mercedes-Benz has been reportedly toying with the idea of integrating a small 1.0-liter turbocharged engine into its electric vehicles (EVs).

Mercedes Unleashes Their Quickest AMG Yet, The 805-HP AMG GT63 S E Performance : Automotive Addicts

Automotive Mercedes has introduced the latest addition to its lineup of high-performance vehicles: the Mercedes-AMG GT63 S E Performance. This