Top Stories

Rafaella Santos And André Lamoglia Seen Together In Rio

Rafaella Santos was seen again in the company of André Lamoglia, heartthrob of the Spanish series “Elite”. The two were

These 12 Young Entrepreneurs Are Turning Their Industries On Their Heads

Original Story: These 12 Young Entrepreneurs Are Turning Their Industries On Their Heads Being a young entrepreneur is no easy However these 12 amazing entrepreneurs make it look easy! They are making waves and changing industries ranging from digital…

Business

Flight attendants at Southwest Airlines seal deal for 22% pay hikes next month

Flight attendants at Southwest Airlines have ratified a contract that includes pay raises totaling more than 33% over four years,

Top Business Magazines Trending Now

The Daily Grind Magazine

The Daily Grind Magazine brings business owners, CEO’s, Founders, and Entrepreneurs the latest business, real estate, investing, and entrepreneurship news from around the world.

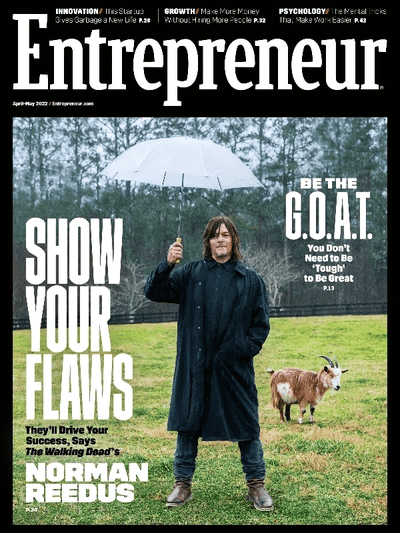

Entrepreneur Magazine

Entrepreneur is an American magazine and website that carries news stories about entrepreneurship, small business management, and business.

Young Innovators Magazine

Young Innovators Magazine highlights young innovators, business owners, CEO’s & Founders, and Entrepreneurs the latest business news from around the world.

Billionaire Investor Magazine

Billionaire Investor Magazine brings high net worth investors, business owners, CEO’s & Founders, and Entrepreneurs the latest business news from around the world.

RealTech Magazine

RealTech Magazine brings their readers the latest news and stories from around the world revolving around technology, business, crypto, blockchain, entrepreneurship, and more.

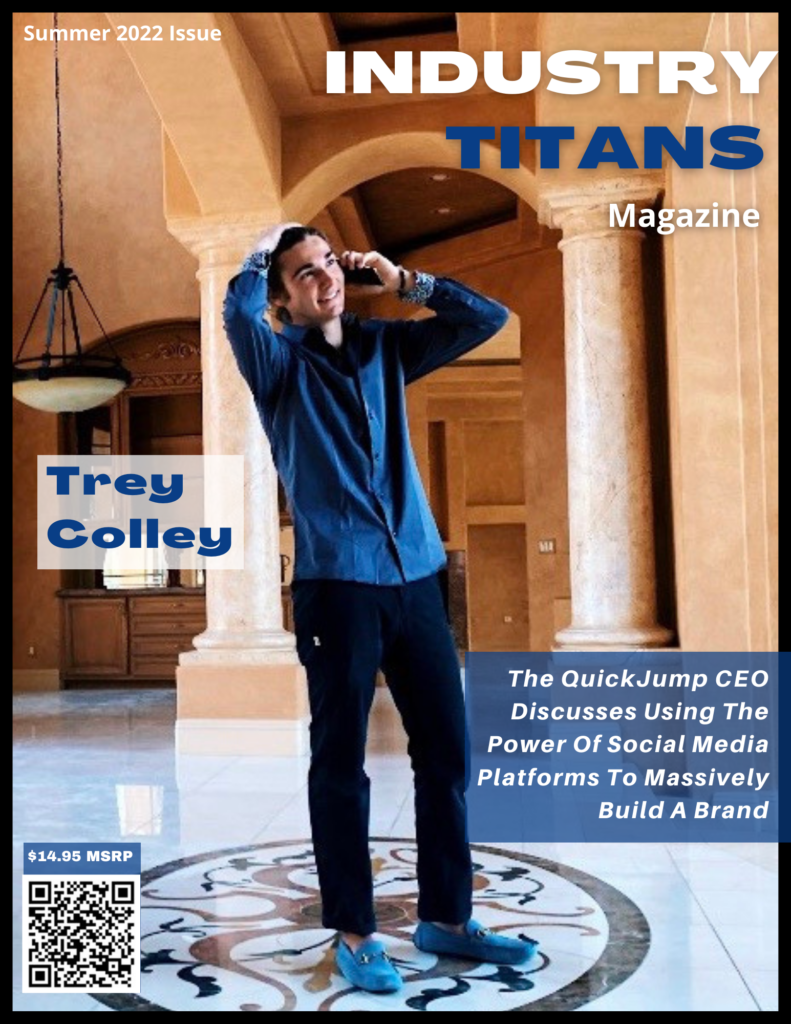

Industry Titans Magazine

Industry Titans Magazine brings business owners, CEO’s & Founders, and Entrepreneurs the latest news from around the world focusing on business & startups founded by young entrepreneurs.

Entertainment

David E. Kelley Shares Updates on ‘Nine Perfect Strangers’ and ‘Big Little Lies’ (Exclusive)

David E. Kelley is keeping the hope of another season alive for fans of Big Little Lies — but staying

‘The Watchers’ Moves to Father’s Day Weekend Release

UPDATED, 12:50 PM: Ishana Night Shyamalan’s debut film is on the move, again. And the new date is a familiar

David Mamet Calls Hollywood’s Diversity Efforts ‘Fascist Totalitarianism’

Play video content Festival of Books / Los Angeles Times David Mamet — who’s written some very famous screenplays in

Top Entertainment Magazines Trending Now

Via Luxury Magazine

Via Luxury Magazine is both a print and digital magazine offering our readers the latest news, videos, thought-pieces, etc. on various luxury Lifestyle topics.

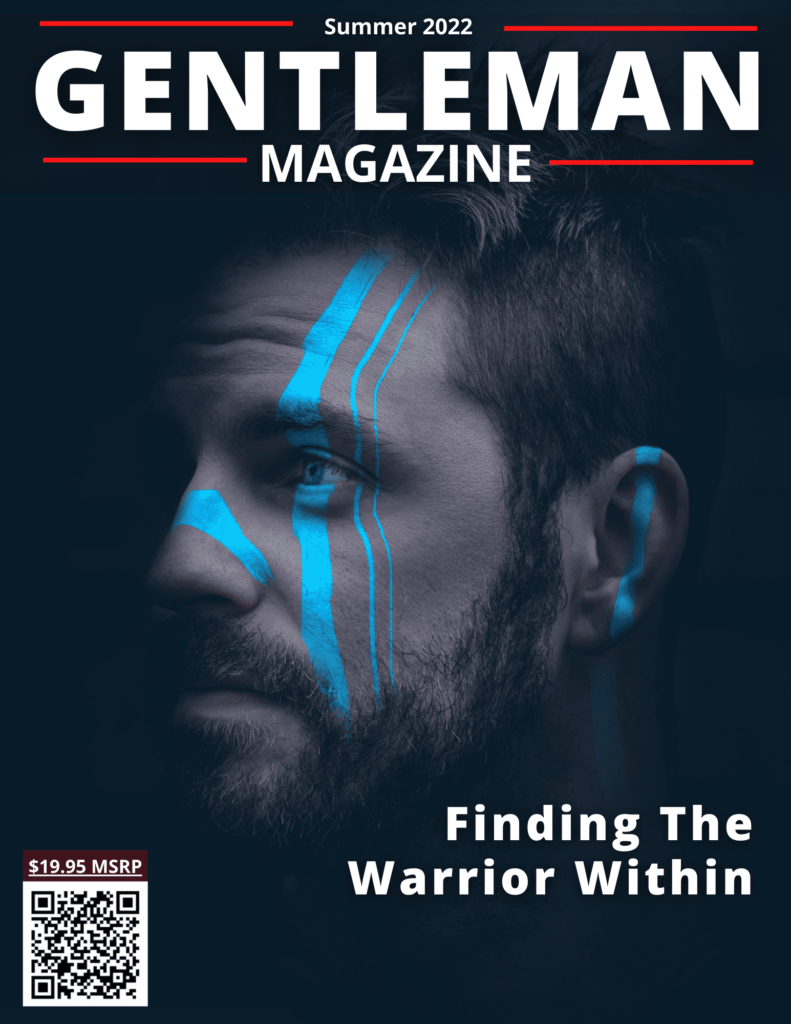

The Gentleman Magazine

The Gentleman Magazine is both a print and digital magazine offering gentleman readers the latest news, videos, thought-pieces, etc. on various Lifestyle topics every good gentleman follows.

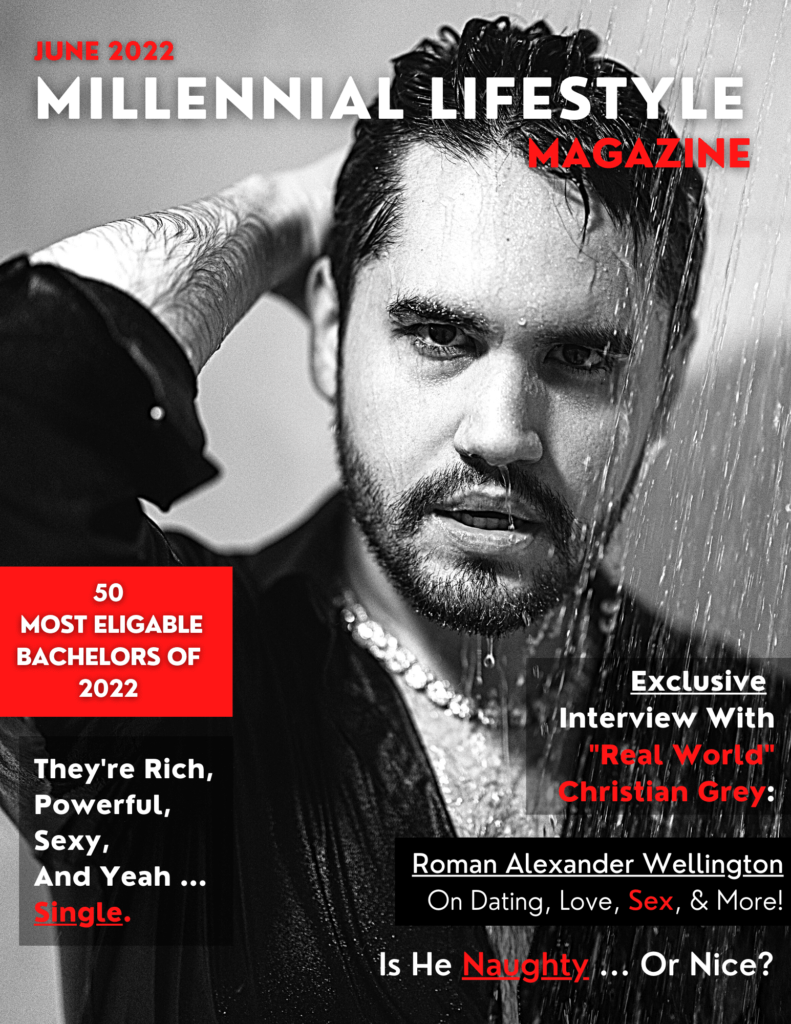

Millennial Lifestyle Magazine

Millennial Lifestyle Magazine is both a print and digital magazine offering readers the latest news, videos, thought-pieces, etc. on various Millennial Lifestyle topics.

Real Estate

The New Reform That Could Unlock $1B+ for Affordable Housing

America is in need of affordable housing; we’re all aware. Buying your first home has become increasingly challenging for everyday

6 Landscaping Projects to Increase Property Value

With the peak of homebuying season just around the corner, it’s more important than ever to make your house stand

Judge Approves $418 Million Settlement That Will Change Real Estate Commissions

A settlement that will rewrite the way many real estate agents are paid in the United States has received preliminary

Automotive

2025 Ram 1500 RHO: Lighter in weight, price and power vs TRX

As Stellantis phases out its line of Hemi V8s, both garden- and hellish-feline-variety, Ram is losing its completely outrageous TRX.

Mercedes-Benz Reveals The First-Ever Electric G-Wagon

The SUV legend finally goes electric… officially. It’s been teased for quite some time, but throughout that period, it’s remained

Mercedes-Benz Ditches Plans For Two-Cylinder Range Extender

Mercedes-Benz has been reportedly toying with the idea of integrating a small 1.0-liter turbocharged engine into its electric vehicles (EVs).