Top Stories

Rafaella Santos And André Lamoglia Seen Together In Rio

Rafaella Santos was seen again in the company of André Lamoglia, heartthrob of the Spanish series “Elite”. The two were

These 12 Young Entrepreneurs Are Turning Their Industries On Their Heads

Original Story: These 12 Young Entrepreneurs Are Turning Their Industries On Their Heads Being a young entrepreneur is no easy However these 12 amazing entrepreneurs make it look easy! They are making waves and changing industries ranging from digital…

Business

Nvidia CEO Jensen Huang Said, “This Is the Beginning of a New World” Thanks to Artificial Intelligence (AI). 1 Stock to Buy If He’s Right

Oregon State University (OSU) broke ground this week on a new research building that will be named after Nvidia CEO

Top Business Magazines Trending Now

The Daily Grind Magazine

The Daily Grind Magazine brings business owners, CEO’s, Founders, and Entrepreneurs the latest business, real estate, investing, and entrepreneurship news from around the world.

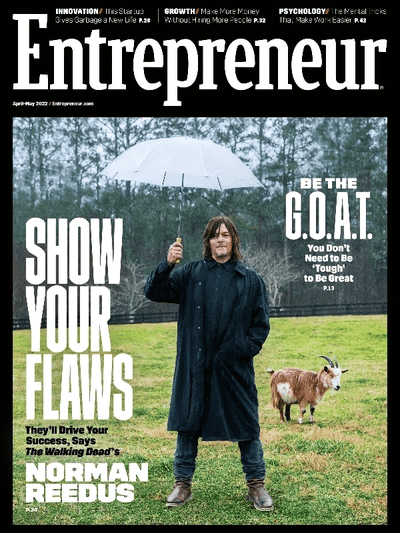

Entrepreneur Magazine

Entrepreneur is an American magazine and website that carries news stories about entrepreneurship, small business management, and business.

Young Innovators Magazine

Young Innovators Magazine highlights young innovators, business owners, CEO’s & Founders, and Entrepreneurs the latest business news from around the world.

Billionaire Investor Magazine

Billionaire Investor Magazine brings high net worth investors, business owners, CEO’s & Founders, and Entrepreneurs the latest business news from around the world.

RealTech Magazine

RealTech Magazine brings their readers the latest news and stories from around the world revolving around technology, business, crypto, blockchain, entrepreneurship, and more.

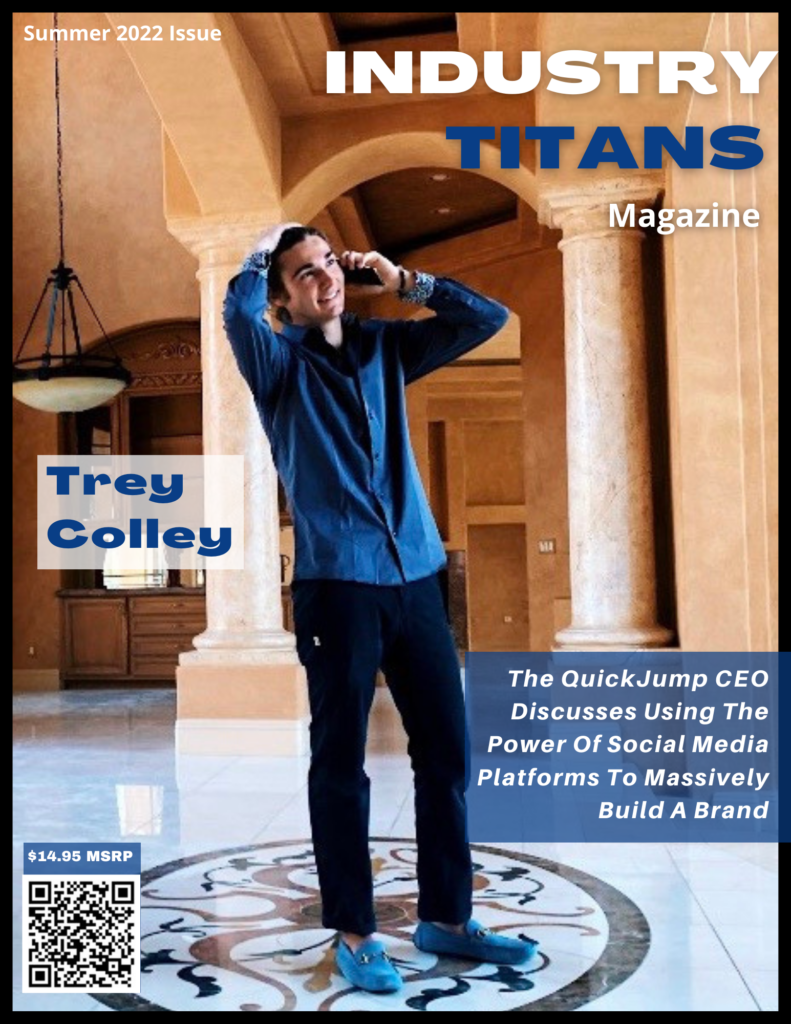

Industry Titans Magazine

Industry Titans Magazine brings business owners, CEO’s & Founders, and Entrepreneurs the latest news from around the world focusing on business & startups founded by young entrepreneurs.

Entertainment

The Best Sandals for Wide Feet That Are as Stylish as They Are Comfy

What to Look for When Shopping for Wide Width Sandals If you’re shopping for sandals that will be comfortable for wide feet, a

Lily Gladstone on Finally Getting to Work With Co-Star Riley Keough in ‘Under the Bridge’ (Exclusive)

Lily Gladstone is gushing over her Under the Bridge co-star Riley Keough. Talking with ET’s Cassie DiLaura from the Los

Trump Seemed to Be Asleep During First Day of Criminal Trial, Reporters Say

Play video content CNN Donald Trump‘s first criminal trial is getting underway, and on the first day of court proceedings

Top Entertainment Magazines Trending Now

Via Luxury Magazine

Via Luxury Magazine is both a print and digital magazine offering our readers the latest news, videos, thought-pieces, etc. on various luxury Lifestyle topics.

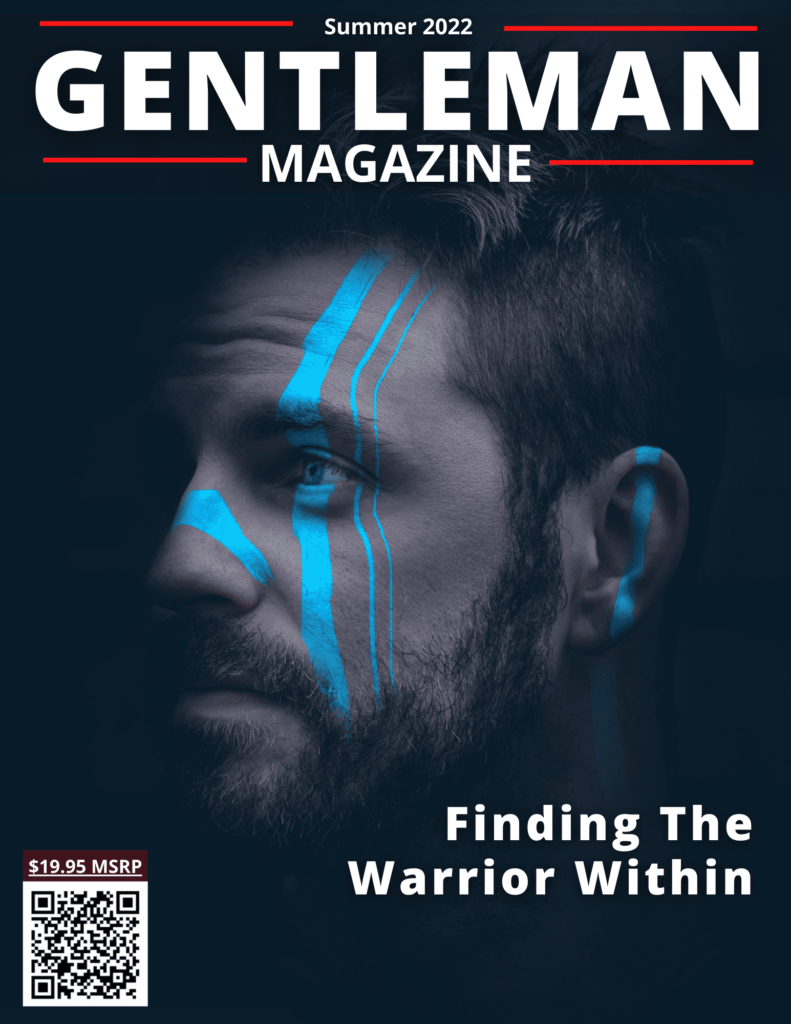

The Gentleman Magazine

The Gentleman Magazine is both a print and digital magazine offering gentleman readers the latest news, videos, thought-pieces, etc. on various Lifestyle topics every good gentleman follows.

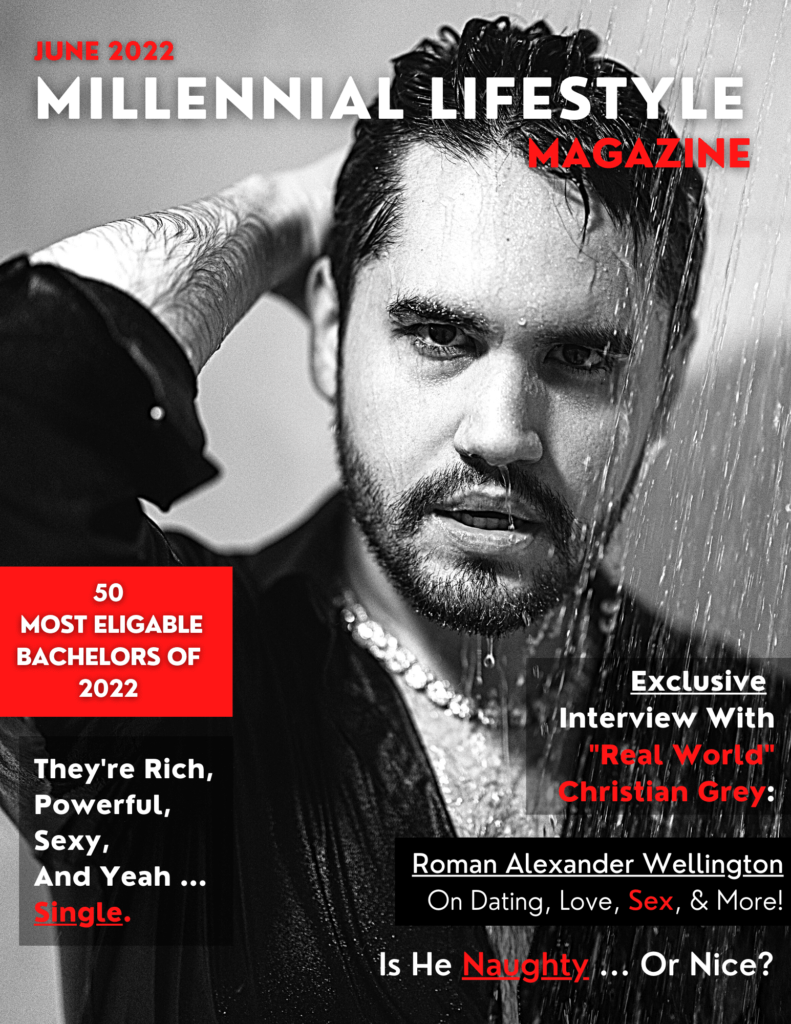

Millennial Lifestyle Magazine

Millennial Lifestyle Magazine is both a print and digital magazine offering readers the latest news, videos, thought-pieces, etc. on various Millennial Lifestyle topics.

Health

Religion

Real Estate

Use Intentional Reflection To Optimize Your Decision-Making

Embrace reflection as a tool for your growth, coaches Emily Bossert and Melanie Klein write. From clarifying your purpose, to

Paying Off Rentals, Estimating Crime

Should I pay off my rental property or reinvest? How do I replace my six-figure salary with cash flow from

Income Needed to Buy Your First Home in Tampa

While it’s less than in Miami, it’s still more than many residents make. Tampa, FL, is known for its crystal

Automotive

2024 Maserati GranCabrio Folgore Introduced as All-Electric 818-HP Convertible

Maserati’s latest offering, the 2024 GranCabrio Folgore, heralds a new era for the Italian automaker as it embraces electrification in

China’s EV export boom fuels surge in demand for new car-carrying ships

BEIJING/SHANGHAI — Chinese automakers and shippers are ordering a record number of car-carrying vessels to support a boom in EV

Exploring The World In Style: Mercedes-Benz’s Top Destinations For Off-Road Enthusiasts

Embarking on an off-road adventure opens up a world of uncharted beauty and thrilling landscapes, perfectly complemented by the capabilities