Top Stories

Rafaella Santos And André Lamoglia Seen Together In Rio

Rafaella Santos was seen again in the company of André Lamoglia, heartthrob of the Spanish series “Elite”. The two were

These 12 Young Entrepreneurs Are Turning Their Industries On Their Heads

Original Story: These 12 Young Entrepreneurs Are Turning Their Industries On Their Heads Being a young entrepreneur is no easy However these 12 amazing entrepreneurs make it look easy! They are making waves and changing industries ranging from digital…

Business

Exxon CEO reiterates that he’s not interested in buying Hess (NYSE:XOM)

NiseriN/iStock via Getty Images Exxon Mobil Corp. (NYSE:XOM) CEO Darren Woods reiterated that he’s not interested in acquiring Hess (NYSE:HES)

Top Business Magazines Trending Now

The Daily Grind Magazine

The Daily Grind Magazine brings business owners, CEO’s, Founders, and Entrepreneurs the latest business, real estate, investing, and entrepreneurship news from around the world.

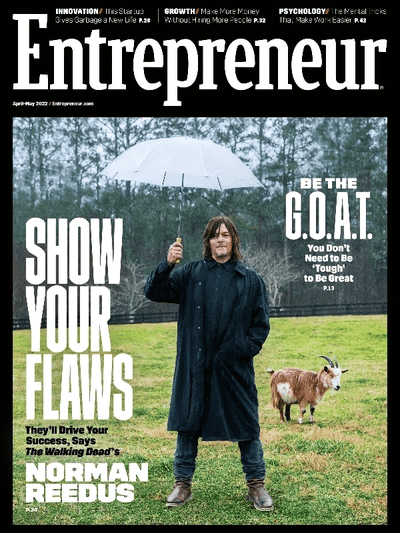

Entrepreneur Magazine

Entrepreneur is an American magazine and website that carries news stories about entrepreneurship, small business management, and business.

Young Innovators Magazine

Young Innovators Magazine highlights young innovators, business owners, CEO’s & Founders, and Entrepreneurs the latest business news from around the world.

Billionaire Investor Magazine

Billionaire Investor Magazine brings high net worth investors, business owners, CEO’s & Founders, and Entrepreneurs the latest business news from around the world.

RealTech Magazine

RealTech Magazine brings their readers the latest news and stories from around the world revolving around technology, business, crypto, blockchain, entrepreneurship, and more.

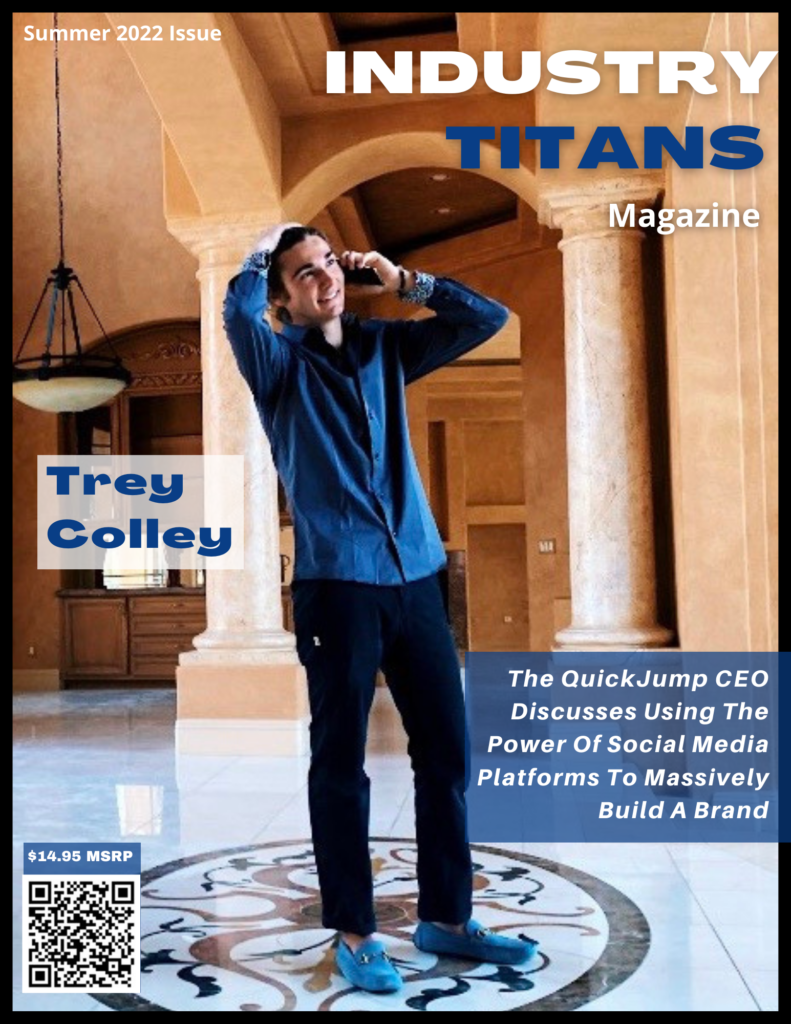

Industry Titans Magazine

Industry Titans Magazine brings business owners, CEO’s & Founders, and Entrepreneurs the latest news from around the world focusing on business & startups founded by young entrepreneurs.

Entertainment

Gypsy Rose Loses Out on $6K From TikTok, Money Transferred to Her Ex

Gypsy Rose is missing a pretty big bag from her TikTok account — several thousand dollars that ended up in

Selena Gomez Addresses Rumors She’s Selling Rare Beauty

“All these confusing things were happening,” Selena explained. “Once I finally found the answer, it wasn’t ‘Oh, I have this

David E. Kelley Shares Updates on ‘Nine Perfect Strangers’ and ‘Big Little Lies’ (Exclusive)

David E. Kelley is keeping the hope of another season alive for fans of Big Little Lies — but staying

Top Entertainment Magazines Trending Now

Via Luxury Magazine

Via Luxury Magazine is both a print and digital magazine offering our readers the latest news, videos, thought-pieces, etc. on various luxury Lifestyle topics.

The Gentleman Magazine

The Gentleman Magazine is both a print and digital magazine offering gentleman readers the latest news, videos, thought-pieces, etc. on various Lifestyle topics every good gentleman follows.

Millennial Lifestyle Magazine

Millennial Lifestyle Magazine is both a print and digital magazine offering readers the latest news, videos, thought-pieces, etc. on various Millennial Lifestyle topics.

Religion

Real Estate

Here’s why new home sales inch higher despite 7% mortgage rates

While the spring housing market has been plagued with low supply, high prices and spiking interest rates, would-be homebuyers are

Did you buy a home with a high interest rate and intend to refinance later?

Ever since mortgage interest rates jumped in 2022, some Californians have had a strategy: Buy now and, once rates drop,

Broker Spotlight: Nancy Almodovar, Nan And Co. Properties

Find out how award-winning Houston broker-owner Nancy Almodovar differentiates her service and elevates her agents at Nan and Company Properties.

Automotive

Cost cutting at Group 1 UK still playing out in Q2 as sales rise

Cost-cutting aimed at saving £10 million annually from Group 1 Automotive’s UK operation are continuing to play out through the

2025 Ram 1500 RHO: Lighter in weight, price and power vs TRX

As Stellantis phases out its line of Hemi V8s, both garden- and hellish-feline-variety, Ram is losing its completely outrageous TRX.

Mercedes-Benz Reveals The First-Ever Electric G-Wagon

The SUV legend finally goes electric… officially. It’s been teased for quite some time, but throughout that period, it’s remained